The following is a guide on some metrics people can use to evaluate if a startup is doing good or bad. It covers metrics observed both externally and internally.

https://www.swyx.io/startups-going-bad

When money was easy, everyone looked like a genius and even the worst run companies could put up some numbers. But in early 2023, we are now in the midst of a tech recession if not a general economic recession.

As Buffett would say; the tide has gone out, and now we see who has been swimming naked.

A friend of mine was recently evaluating job offers and one was clearly a startup that was “going bad”. It was clear to me but not to them; I figured I would write a post spelling out some things I look at.

Why it’s worth talking about the Unhappy Path

People love to talk up about startups on the way up. VCs want to demonstrate they saw the potential early, founders want to recruit employees and customers, media want access to a future unicorn, and nobody wants to punch down on the little guy. Outrage and dramatic disasters get the most attention, but a good second place to that is the positive happy vibes of someone genuinely trying to “make the world a better place”.

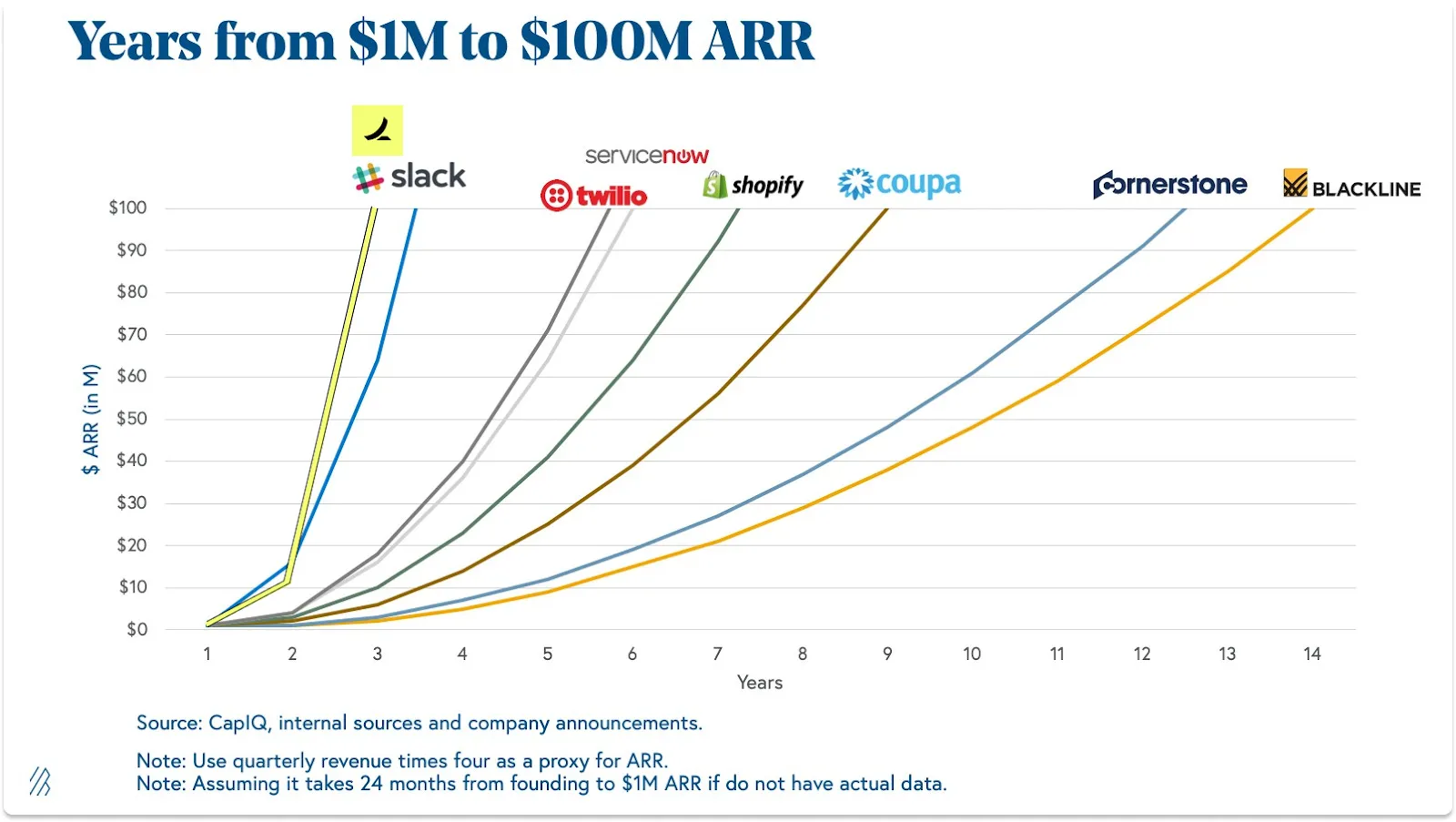

There’s a certain obsequious boosterism that forms around startups in their early days: early milestones are hit, growth numbers are strong, and some form of up-and-to-the-right chart with no Y axis drives the narrative. A rare few even do end up boasting the most meaningful Y axis of all: revenue.

Positive stories are also a much easier and cleaner story to tell; as Tolstoy would put it, all rocketship startups are alike, but every fading startup is fading in its own way, for entirely different reasons depending on who you ask.

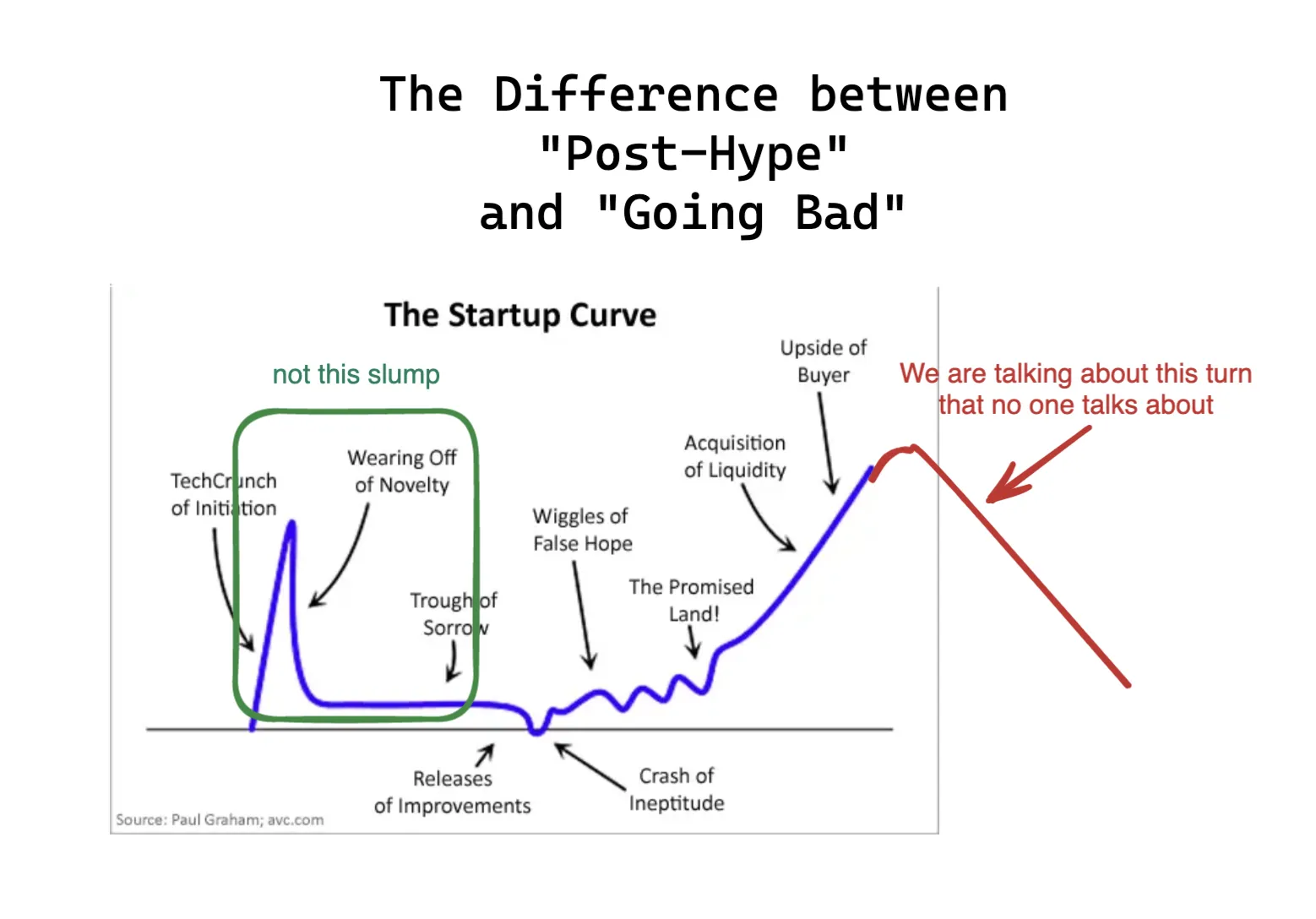

We’re here to talk about the other side of the S curve. Many startups-going-bad will handwave away their decline by saying it is the post-hype path, but don’t be fooled. We’re talking about the inconvenient, unspoken part of Paul Graham’s Startup Curve:

When I was newer to the startup game I felt that unease, but couldn’t really do anything about it (nor had I seen enough to know). But now I see the impact on the work and careers of people who aren’t “clued in” enough to know when a once-great company is no longer the same. Then, many years after it’s obvious to everybody else but you, people openly say things like ”the company was on trajectory of death” but that’s too late when you’ve made significant career, tech stack, or other forms of investment choices already.

So I figured I’d jot down some things I’ve seen to form a mental checklist, and perhaps get more ideas from others who have seen the same.

Disclaimers

Please note that this list is informed by experiences both from companies I’ve worked at and companies I’ve only observed via friends/my network, so don’t derive any signal from my work history.

Also, companies can often go through phases where they are down and then get revived again (most famously Apple), so down-for-now is not down-for-ever.

Alright, with all the necessary disclaimers out of the way:

Signs that a Startup is Going Bad

Although you can use this to make tech stack and investing decisions, since this is primarily meant to help startup employees evaluate job offers, we will focus on a clear distinction between externally observable indicators (for joining) and internally observable indicators (for leaving).

- External signs

- People: Key executives leaving in a short period (Slack’s exodus is a high profile extreme of this) or builders of key products “shipping and dipping” (a common move to end their time at the startup on a personal high note when they have already determined that it’s going bad)

- Community: Response to product launches and company events on social media, and related chatter. When a startup is on the decline, both the quantitative and qualitative reactions will show diminished excitement compared to past glory. This alone is not a decider, as no company can keep up a hot streak forever, but it’s a factor.

- A simple indicator is frequency of company social media posts. This is an obviously flawed metric, and you can overindex on it, but a startup that last updated 6-12 months ago is a little higher risk of having gone bad than one that hasn’t tried at all.

- Founder engagement: If the founder is active on social media (many aren’t) - are they visibly less in love with their own startup? Some distraction is OK, but declining engagement with users, declining self promotion/celebration, declining championing of company mission is a sign.

- Product:

- Roadmap: (After basic research) If it’s unclear what users want to see next from the startup… maybe they don’t care enough to want anything at all.

- Ambition: when was the last time the startup shipped something that was technically hard/blew minds instead of incremental/low hanging fruit?

- Polish: is there attention to detail in the UX/DX/Docs/Marketing? Is it getting noticeably worse? That’s because the # of people who actually give a shit is declining. Is the startup a feature factory, shipping thing after thing in Beta that doesn’t add up to a coherent direction?

- Non-Signals:

- Job openings: I used to track the length of startup careers pages as a proxy for how well they are doing - a fantastic leading indicator of whether or not a startup just got a major round of funding is a sudden 2x-ing of job openings. Whether or not this had any value in the past, it definitely has no value today because startups are all focused on efficiency and not-hiring can be as good of a sign as hiring; therefore this just a nonsignal.

- Internal signs

- Transparency: as a company goes bad, the number of backpatty events and allhands and announcements and emails will trend down since there is less good news to report. A founder that doesn’t do at least a (quarterly if small, annual if large) “state of the union” is big red flag.

- “Shifting Goalposts Down” is a leading indicator of declining transparency, where more meaningful indicators that no longer look so good are swapped for less meaningful ones that still look good. Watch for the bait-and-switch - and don’t be offended because this happens to us all.

- People: similar to the “externally visible” point above, but this time filtered for “competent people” based on your understanding of their work and opportunity set (incompetent people leaving is a nonsignal). This is clearly more subjective but inside a company, you can often have more visibility on whether “the good people” in the company are voluntarily leaving.

- Involuntary departures also offer some signal, but I haven’t determined how to distinguish “business as usual” firings vs “startup is going bad” firings yet.

- Offset this by also considering the high-opportunity-set people coming inbound (e.g. Sarah Drasner joining Netlify, Steve Yegge joining Sourcegraph, Malte Ubl et al joining Vercel)

- Customers: Churn going up (aka customers leaving) is a clear negative sign. Beyond that, most startups these days openly share revenue numbers internally, so there should be no surprise there, but there is a semi-quantifiable concept of ”quality of revenue” that you only get if you look past the headline number. Be honest about whether your revenue comes from selling a dollar’s worth of services for ten cents, and whether the value proposition of new sales is increasingly reliant on unsustainable promises.

- NPS/PMF score: I’ll be the first to say that NPS is very flawed, but a bad or declining NPS is actually a red flag (and its easy to measure so not tracking it is also not good). If you think NPS is overdone, you can use a PMF score (popularized by Rahul Vohra) instead.

- Transparency: as a company goes bad, the number of backpatty events and allhands and announcements and emails will trend down since there is less good news to report. A founder that doesn’t do at least a (quarterly if small, annual if large) “state of the union” is big red flag.

Thanks to Vijay (anon) and Kareem for contributing some ideas in this list!

What else?

I wrote this post to send generic startup advice to a friend evaluating some offers, but I probably missed some obvious ones. Please leave comments on other things that can indicate a startup is on it’s way down! The less obvious, the more leading-indicator, the better.